iowa inheritance tax rates 2020

Track or File Rent Reimbursement. 2022 taxiowagov 60-064 05312022.

Inheritance Tax Penalizes Those Already Suffering Itr Foundation

Iowa is phasing out its inheritance tax by reducing its rates by an additional 20 percent each year from the.

. Adopted and Filed Rules. See Iowa Code section 4504. The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed.

25001-75500 has an Iowa inheritance tax rate of 7. Register for a Permit. 2021 taxiowagov 60-062 01032022.

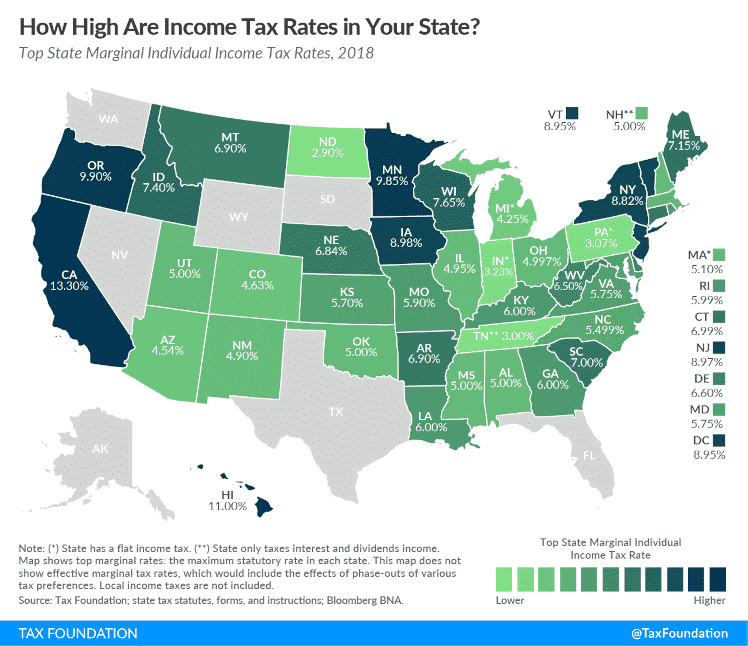

That is worse than Iowas top inheritance tax rate of 15. If the net value of the. The hope is to convince more retirees to choose Iowa as their state of.

A bigger difference between the two states is how the exemptions to the tax. The estate tax is a tax on a persons assets after death. If your relation to the person leaving you money is any of the above you wont owe inheritance tax regardless of the size of your inheritance.

Iowa Inheritance Tax Rates. For more information on the limitations of the inheritance tax clearance see. In many states the estate tax ranges from 08 to 16.

What is the inheritance tax 2020. These tax rates are based upon the relationship of. In 2020 federal estate tax generally.

Iowa is planning to completely. A summary of the different categories is as follows. 2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows.

The repeal of the Iowa inheritance tax follows the trend across the country to reduce such taxes. States that collect an inheritance tax as of 2020 are Iowa Kentucky Maryland Nebraska New Jersey and. Report Fraud.

If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000. It is most common for Iowa inheritance tax to be due when estate shares are left to non-lineal relatives of the decedent such as brothers sisters nieces nephews aunts uncles or cousins. The Tax Cuts and Jobs Act TCJA doubled the estate tax exemption to 1118 million for singles and 2236 million for married couples but only for 2018 through 2025.

That is worse than Iowas top inheritance tax rate of 15. Iowa Inheritance Tax Rates. If the net estate of the decedent found on line 5 of IA.

Change or Cancel a Permit. Up to 25 cash back Spouses children and parents of a deceased person are exempt from Iowa inheritance tax while other inheritors might have to pay. Subject to Iowa inheritance tax.

0-12500 has an Iowa inheritance tax rate of 5. 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by. The states with the highest estate tax rates are Hawaii and Washington where the tax ranges from 10 to 20.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Idaho state income tax rate table for the 2020 - 2021 filing season has seven income tax brackets with ID tax rates of 1125 3125 3625 4625 5625 6625 and 6925. An exemption from Iowa inheritance tax for a qualified plan does not depend on the relationship of the beneficiary to.

Unlike federal estate taxes which are paid by the estate Iowas inheritance tax is paid by the beneficiary. 12501-25000 has an Iowa inheritance tax rate of 6. Grow Your Legal Practice.

Iowa Inheritance Tax Rates. Alternatively or in addition you can ensure that the beneficiaries. For decedents dying on or after January 1 202 but before January 1 2022 the 3applicable tax rates listed in Iowa.

It has an inheritance tax with a top tax rate of 18. What is the federal inheritance tax rate for 2020. The exemption level is.

The Iowa inheritance tax rate varies depending on the relationship of the inheritors to the deceased person. Inheritance Tax Rates Schedule.

Death And Taxes Nebraska S Inheritance Tax

Iowa Estate Tax Everything You Need To Know Smartasset

Details On The Iowa Inheritance Tax Repeal Beattymillerpc Com

What Is The Estate Tax In The United States The Ascent By The Motley Fool

A Guide To The Federal Estate Tax For 2021 Smartasset

Do I Have To Pay Taxes When I Inherit Money

.png)

Iowa Inheritance Tax Law Explained

What Is Inheritance Tax Probate Advance

Tax Talk Iowa S Inheritance Tax Gordon Fischer Law Firm

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

Death And Taxes Nebraska S Inheritance Tax

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

How Do State And Local Individual Income Taxes Work Tax Policy Center

Tax Talk If You Die In Iowa Is There A State Estate Tax Gordon Fischer Law Firm

Death And Taxes Nebraska S Inheritance Tax

Estate Tax Implications For Ohio Residents Ohio Estate Planning